Consumption tax in Japan varies according to the type of product you are purchasing

One of the main tax raising in any country is the consumption tax, in other words, the tax you pay on transactions such as the purchase of goods and products, and payment for the services. The amount paid goes to the companies that, in turn, collect the amount from the government.

In Japan the law is recent and still causes great confusion.

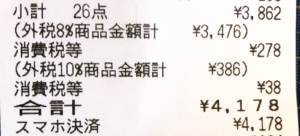

Many places, such as supermarkets, still display the prices of products without the tax to be charged at the time of payment. . This is due to the recent history of the creation of the tax (1989). It is very common to receive invoices with the amount without tax, the amount of tax, and the amount to be paid.

The Japanese government has increased the tax rates from 5% to 8% and 10%. he 8% tax is charged for food and beverages (except alcoholic beverages) at the supermarket, but if you decide to go to a restaurant the tax is 10%. All other consumer products are now taxed at 10%.