Paying taxes in Japan is a resident citizen’s obligation, whether you are Japanese or a foreigner

Juminzei is a regional tax and is paid to the prefectures where you are registered. The amounts charged vary depending on the city/municipality you live in and is calculated based on your household income from the previous year in Japan.

If you have just arrived in Japan, you do not have to pay taxes for the first year. However, you will have to contribute starting the next year if the wages you receive exceed the minimum taxable amount.

What determines which prefecture the tax has to be paid to is the date of January 1. You must pay to the municipality where you are registered on the first day.

The Juminzei is charged in four to 12 installments, depending on the amount to be paid.

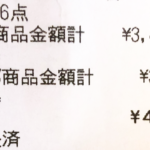

Payment can be made using the Tax Payment Notice (Nozei Tsuchisho) or the Tax Payment Billet (Nofusho) sent by the municipal tax office.

For those who work for companies that discount the tax from the payroll, the juminzei is divided into 12 installments and debited in the monthly salary, from June to May of the following year.